Recent developments have highlighted a growing rift between the United States and the European Union over the application of EV tax credits for European car manufacturers. The heart of the issue lies in the Inflation Reduction Act (IRA), which sets forth new terms for electric vehicle (EV) incentives, inadvertently nudging EU-produced cars outside the eligibility bubble. With the presidential election on the horizon and no meetings scheduled before the vote, the clock is ticking for both parties to find common ground on EV policies.

Economic Barriers Raised by the Inflation Reduction Act

The United States’ Inflation Reduction Act has not only raised trade barriers against China but has also inadvertently ensnared European electric vehicles due to restrictions on the origin of materials and components for EV batteries. Under this act, a significant percentage of the critical minerals used in batteries must be sourced from the United States or its free trade partners—a category in which, currently, only Canada and Mexico fall. These requirements, set to escalate further by 2027, have ignited transatlantic trade tensions with no solution yet in sight from ongoing negotiations.

US-EU Trade Negotiations: A Rocky Road

Far from reaching a consensus, the US and EU seem to have hit a snag in their efforts to iron out trade issues, particularly in the realm of raw materials for EV batteries. Despite initial optimism, a once-hinted “basic agreement” has evaporated from the final announcements. The European Union, feeling the sting of the IRA’s excluding measures, has pushed back by loosening its subsidy rules even as it engages in talks with the American administration. Yet there’s an evident split on the formal aspects of the agreement, and internal EU discussions hint at doubts about the overall value of the accord.

Labor Standards: A Contested Cornerstone of Negotiations

The sketches provided by insiders reveal an impasse on the matter of labor standards. The United States is firm on its right to conduct inspections at sites to validate compliance, especially in the context of China’s predominant role in the supply chain and concerns over forced labor. This has evolved into a pivotal point in discussions with the EU, which is likewise concerned with human rights and fair labor practices.

Towards an EU-US Raw Materials Partnership?

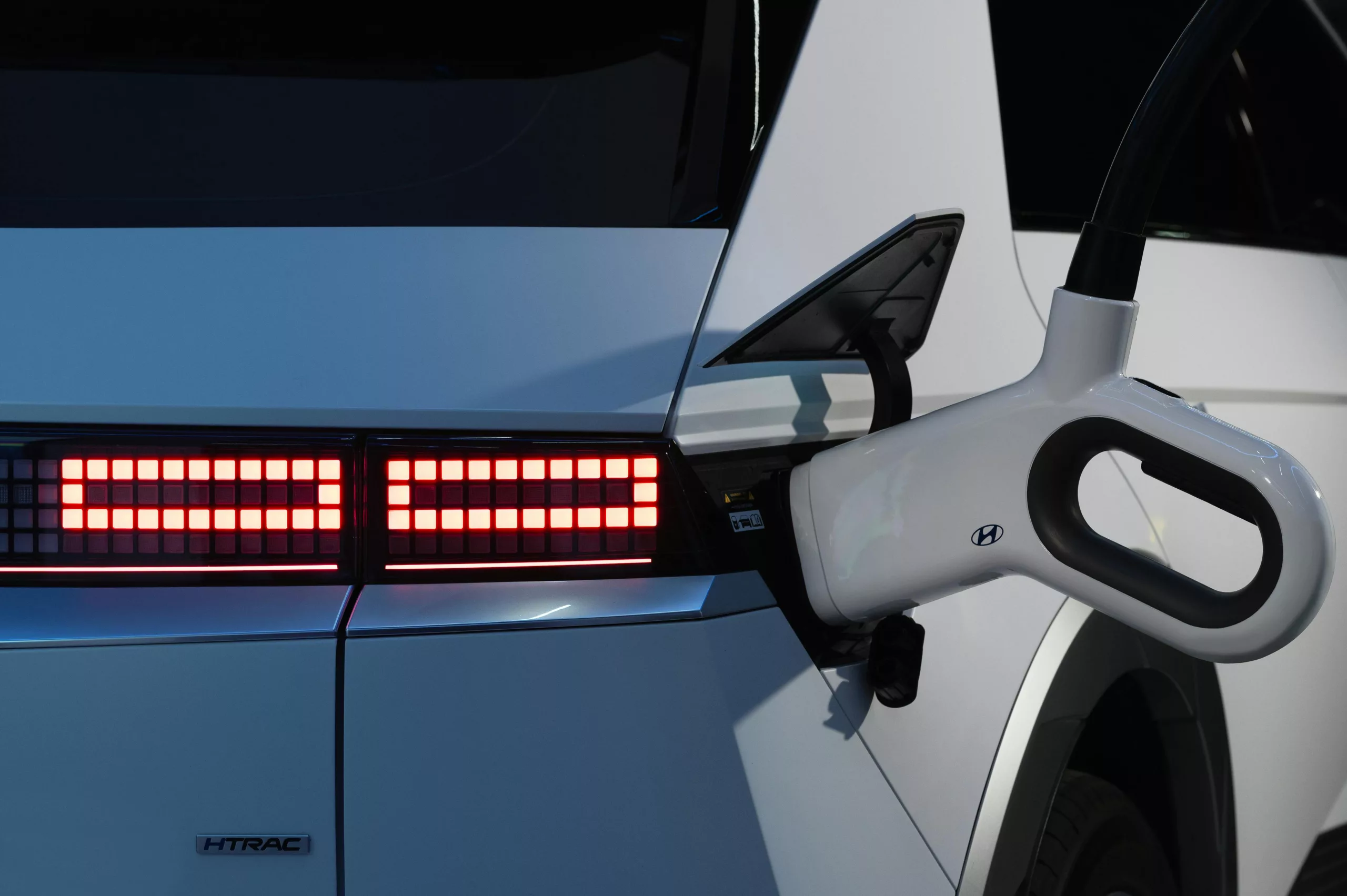

The potential banning of forced labor products in the EU could pave the way for a breakthrough in US-EU negotiations over critical minerals. The alignment over labor rights increases the prospects of a deal, one that could expand EV rebate eligibility to European cars, albeit partially. Currently available via a leasing loophole, the full tax rebate remains elusive unless cars are commercially utilized or assembled within the United States.

In the interim, a working group has emerged as a platform for ongoing dialogue: the “Minerals Security Partnership Forum.” This endeavor spotlights raw materials vital for technological advancements and sustainability efforts. Although the EU lacks the mining infrastructure of its North American counterparts, an agreement could elevate its stature and influence in the EV materials market, sending positive signals to the industry.

Shifting Gears in Global Automobile Manufacturing

The race for EV supremacy is reshaping the auto industry’s global landscape. China has established a near monopoly in battery components, seizing the initiative from Western nations. Reactions to the IRA’s selective trade practices have been a potpourri of strategies, from new foreign battery plant investments to formal complaints at the World Trade Organization. Amid the tumultuous transition to EVs, stakeholders worldwide are repositioning themselves, preparing for a future where electric mobility reigns supreme. The likelihood of a US-EU agreement looms large, driven by mutual benefits and the immense stakes involved.